Bagley Risk Management Solutions: Your Shield Against Unpredictability

Bagley Risk Management Solutions: Your Shield Against Unpredictability

Blog Article

How Livestock Danger Protection (LRP) Insurance Can Secure Your Animals Financial Investment

In the world of livestock investments, mitigating threats is paramount to ensuring financial security and growth. Livestock Danger Security (LRP) insurance coverage stands as a trustworthy guard versus the unpredictable nature of the marketplace, providing a calculated technique to safeguarding your assets. By delving right into the ins and outs of LRP insurance and its complex advantages, animals manufacturers can strengthen their investments with a layer of safety that goes beyond market fluctuations. As we explore the world of LRP insurance policy, its duty in securing animals investments comes to be increasingly apparent, assuring a course towards lasting financial strength in an unstable industry.

Comprehending Animals Risk Protection (LRP) Insurance

Comprehending Livestock Danger Security (LRP) Insurance coverage is vital for animals producers aiming to mitigate financial risks connected with cost variations. LRP is a federally subsidized insurance coverage item developed to protect producers versus a drop in market value. By supplying coverage for market value decreases, LRP helps manufacturers lock in a flooring price for their animals, ensuring a minimal level of revenue no matter of market fluctuations.

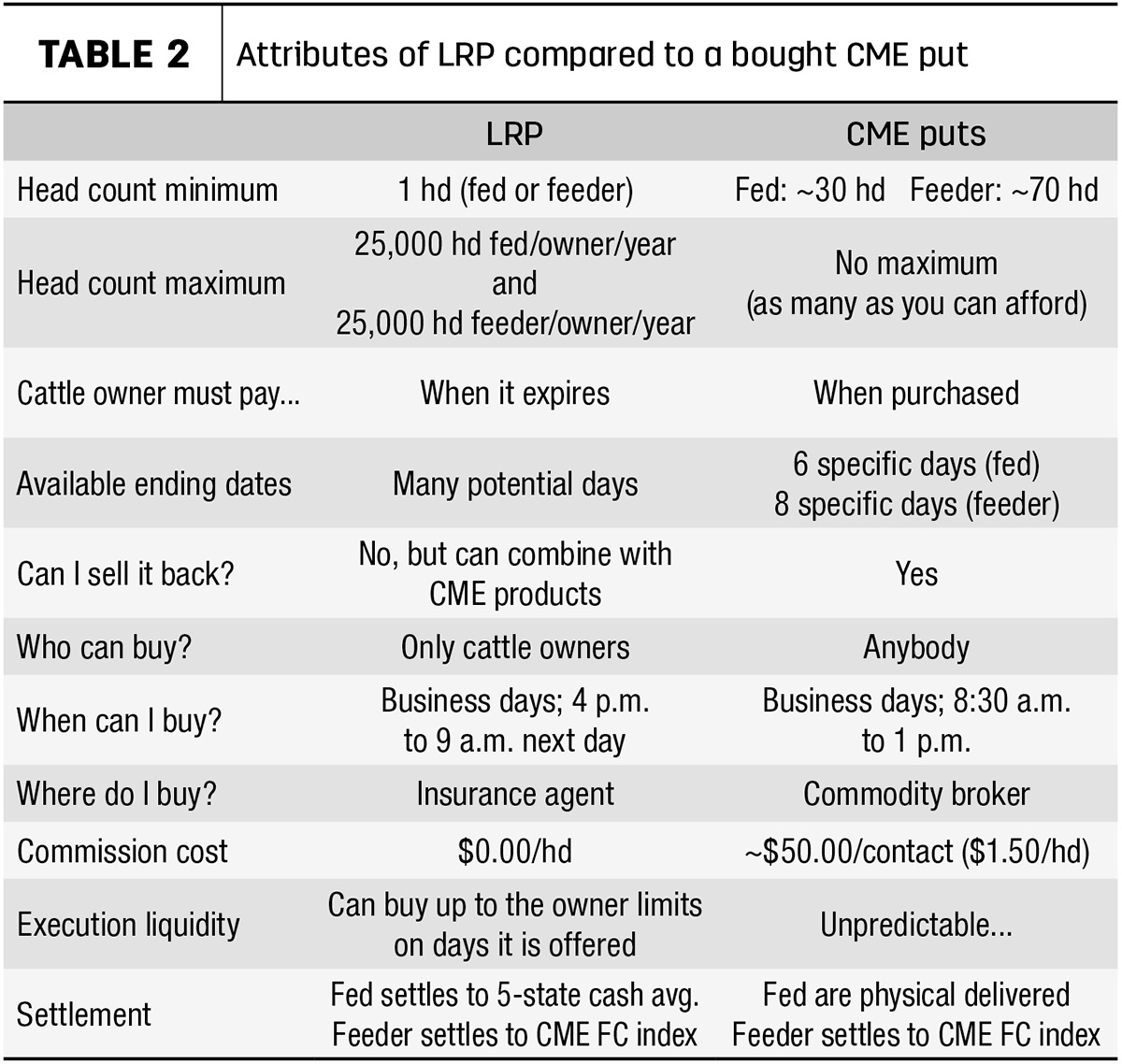

One key facet of LRP is its flexibility, enabling producers to personalize coverage degrees and plan sizes to match their specific requirements. Manufacturers can select the variety of head, weight array, insurance coverage rate, and insurance coverage period that line up with their production goals and take the chance of resistance. Understanding these personalized choices is vital for manufacturers to efficiently handle their cost threat exposure.

Moreover, LRP is available for different livestock kinds, including livestock, swine, and lamb, making it a versatile risk monitoring device for animals manufacturers across different markets. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make enlightened choices to secure their financial investments and ensure financial stability in the face of market unpredictabilities

Advantages of LRP Insurance Coverage for Livestock Producers

Animals producers leveraging Animals Danger Security (LRP) Insurance acquire a tactical advantage in securing their investments from price volatility and safeguarding a steady monetary ground in the middle of market unpredictabilities. By establishing a flooring on the rate of their livestock, producers can minimize the risk of substantial economic losses in the event of market recessions.

In Addition, LRP Insurance supplies manufacturers with peace of mind. Generally, the benefits of LRP Insurance policy for animals manufacturers are significant, using an important tool for handling risk and making sure economic safety in an unforeseeable market atmosphere.

How LRP Insurance Coverage Mitigates Market Risks

Minimizing market dangers, Animals Risk Security (LRP) Insurance policy supplies animals manufacturers with a reliable shield versus rate volatility and financial unpredictabilities. By using protection against unforeseen cost declines, LRP Insurance coverage helps producers safeguard their investments and maintain economic stability despite market changes. This sort of insurance policy enables livestock manufacturers to lock in a price for their pets at the start of the plan period, making sure a minimal cost level no matter market adjustments.

Actions to Protect Your Animals Investment With LRP

In the world of agricultural danger monitoring, carrying out Animals Risk Protection (LRP) Insurance includes a critical procedure to safeguard financial investments versus market variations and uncertainties. To protect your livestock investment properly with LRP, the primary step is to examine the certain risks your operation encounters, such as cost volatility or unexpected weather condition events. Comprehending these threats enables you to establish the protection degree needed to shield your investment adequately. Next, it is crucial to study and select a respectable insurance copyright that offers LRP policies tailored to your animals and organization needs. Carefully evaluate the plan terms, problems, and go to my blog insurance coverage limits to ensure they straighten with your risk monitoring goals once you have actually selected a provider. Additionally, consistently keeping track of market fads and adjusting your protection as needed can aid optimize your defense against prospective losses. By complying with these actions vigilantly, you can enhance the security of your livestock investment and navigate market unpredictabilities with confidence.

Long-Term Financial Protection With LRP Insurance Policy

Making certain sustaining economic security with the usage of Livestock Risk Protection (LRP) Insurance policy is a sensible long-lasting strategy for farming manufacturers. By integrating LRP Insurance coverage into their threat administration strategies, farmers can protect their livestock financial investments versus unexpected market fluctuations and damaging occasions that could jeopardize their financial wellness gradually.

One secret advantage of LRP Insurance coverage for lasting financial safety and security is the satisfaction it supplies. With a dependable insurance coverage in position, farmers can minimize the economic risks related to unstable market conditions and unexpected losses as a result of variables such as illness outbreaks or all-natural catastrophes - Bagley Risk Management. This stability allows producers to concentrate on the everyday procedures of their livestock company without continuous bother with potential monetary setbacks

In Addition, LRP Insurance coverage gives an organized method to taking care of danger over the lengthy term. By setting certain coverage degrees and choosing proper recommendation periods, farmers can tailor their insurance policy plans to line up with their economic goals and run the risk of resistance, guaranteeing a lasting and safe and secure future for their animals operations. To conclude, purchasing LRP wikipedia reference Insurance policy is a proactive technique for agricultural manufacturers to attain long lasting monetary safety and shield their livelihoods.

Final Thought

In final thought, Animals Danger Defense (LRP) Insurance coverage is an important device for animals producers to reduce market risks and safeguard their financial investments. It is a smart choice for safeguarding animals financial investments.

Report this page